Welcome to the Hilltop

Since 1889, Saint Anselm College has provided a transformative education shaped by Catholic and Benedictine values and a liberal arts foundation. Here, you are part of a welcoming community where you will discover your passions, experience cherished traditions, and unlock your full potential.

Top100.00100

national liberal arts college by Forbes

99.0099%

of identified graduates of the class of 2023 are either employed, pursuing further education, serving in the military, or volunteering

#24.0024

most engaged in community service by Princeton Review

Celebrating 50 Years of Women’s Education

This year marks 50 years of women’s education and achievements at Saint Anselm College. To commemorate this extraordinary milestone, the college is celebrating with events and programs centered around the women of the past and present who have made Saint Anselm College what it is today.

Meet Our Anselmians

"I believe with all my heart that today’s world needs Saint Anselm College, a place that is infused with the Catholic and Benedictine values of community, hospitality and love, where the humanities, arts and sciences and professional programs like nursing, criminal justice and business build on our liberal arts core rather than compete with it. We need a place where you don’t have to choose between career outcomes and life outcomes. That place is Saint Anselm."

In the classroom and in the community, an Anselmian education will challenge you to find your best self.

Anselmian News

Interdisciplinary Special Topics Course is “Unlike Any Other”

Last fall, a new special topics course blended history and literature in a…

Anselmians Make Record Gifts to Support Saint Anselm College Now and Always

During the 10th annual Days of Giving campaign, the college a record $1.43…

Saint Anselm students play role in President Biden’s NH visit

Students reflect on the important role they played in President Biden’s…

Chapel Arts Center Hosts a Retrospective on long-time Photography Professor

“The Intimacy of Seeing: Elsa Voelcker – A Retrospective,” the current…

Meelia Center's 32nd Annual Valentine's Dance Spreads Love and Inclusion in the Community

The Meelia Center for Community Engagement spread love in the community as…

NHIOP Welcomes 2024 Cohort of Kevin B. Harrington Student Ambassadors

The New Hampshire Institute of Politics welcomes 29 new Student Ambassadors…

Saint Anselm Men’s Basketball Coach Keith Dickson Announces Retirement; Chris Santo ‘15 Named New Head Coach

After 38 years and 719 victories across 37 seasons, Saint Anselm College…

Write-In | April 16 | 7-10 p.m.

Get your writing done in the company of others!

The Academic…

FEATURED FACULTY MEMBER

Theology Professor Ahida Pilarski, Ph.D. was featured in the most recent issue of Portraits Magazine's Focus on Faculty.

"The first program in women’s studies in the United States was approved at San Diego State University in 1970. Saint Anselm College also is celebrating the 50th anniversary of women at the college this year. It is nice to know that our college joined this major change of increasing the access of women to education."

Anselmian Events

The Women in Business Club will be hosting a spring luncheon on Sunday, April 14th from 11am-1pm to celebrate the accomplishments that the club has had throughout the year. The event will include a catered lunch for all attendees.

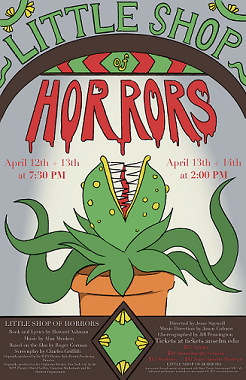

The meek floral assistant Seymour Krelborn stumbles across a new breed of plant he names "Audrey II" - after his coworker crush. This foul-mouthed, R&B-singing carnivore promises unending fame and fortune to the down and out Krelborn as long as he keeps feeding it, BLOOD. Over time, though, Seymour discovers Audrey II's out of this world origins and intent towards global domination!

Performances:

April 12th 7:30pm

April 13th 2:00pm & 7:30pm

April 14th 2:00pm

Ticket prices are as follows:

$25 Reserved

$20 Alumni/Faculty/Seniors

$15 Non SA Student

$12 Saint Anselm Students

*ALL SALES ARE FINAL

*NO REFUNDS OR EXCHANGES

Event details for Anselmian Abbey Players Present: Little Shop Of Horrors

Please join us for Mass in the Abbey Church!

Join our weekly athlete Bible study.

Varsity, Club, and Intramural Athletes are welcome!

Contact us for more info: Campusministry@anselm.edu

Delight is a space where women of all faith backgrounds can come together for supportive conversations about pursuing a relationship with Jesus.

For more information, contact us: CampusMinistry@anselm.edu

Join your peers and enjoy free pizza and conversation about current political news in an informal setting.

The special guest on 4/15/2024 is Communication major Kathryn Williams '24. Williams will speak about her work with the new Saint Anselm podcast: Belief and Ballots.

Free and open to Saint Anselm students. Please RSVP by emailing nhiop@anselm.edu.

Event details for Pizza & Politics with Kathryn Williams '24